Getting Down to the Numbers Themselves

-

Spreadsheets can help you understand and manage settlement offers. A spreadsheet provides a clear and organized view of your finances, making it easier to assess the impact of different settlement proposals.

Use spreadsheets to compare different types of accounts. Retirement accounts, non-retirement accounts, bank accounts, and investment accounts may be treated differently in a settlement. Ensure you are comparing apples to apples when making decisions.

Familiarize yourself with the concept of equalizing.

Equalizing is the process of distributing assets equally between spouses. This involves calculating the total value of marital assets and dividing it equally.Share spreadsheets with the other party early on.

This can help identify areas of agreement and build trust, leading to more productive settlement discussions.Use spreadsheets for settlement projections.

By creating different scenarios in a spreadsheet, you can see the potential financial impact of various settlement options. This allows you to make informed decisions about child support, expenses, and other financial matters.

Getting Down to the Numbers Themselves

Last month, we did a blog post walking through how to use spreadsheets, which gives you a powerful way to step onto solid ground and get a calm, informed look at whether a settlement works for you.

This month, I want to explain the numbers you’ve been entering and give you five tips that will help you learn what those numbers really mean and an effective way to consider a settlement offer.

1. Really. Try a spreadsheet. All the figuring becomes easier when the numbers are organized.

I know you may be resisting and that it may seem tedious and even overly technical to create spreadsheets, but let me repeat: The clarity you’ll gain is worth the effort. It’s a game-changer.

When you plug your information into a simple spreadsheet and bring it to your settlement conferences, it will act as a roadmap and put you at the head of the case. You’ll be calmer, in command of the specifics, and more empowered to see what you have, determine what you need, and work toward a settlement that makes sense for you.

2. Trade apples for apples.

When you glance at your spreadsheet and see balances for various accounts, don’t assume that the money in every account is treated the same way. Retirement accounts and non-retirement accounts are often treated differently, as are bank accounts and investment accounts. They may be taxed differently or subject to different rules regarding interest or withdrawals.

So when your spouse wants to trade assets in one class of accounts (non-retirement) for assets in another class of accounts (retirement), be careful that you’re trading apples for apples—that is, be sure you’re trading a dollar in one type of account that is actually the same, after taxes or penalties or other conditions, as a dollar in another account. Ask as many questions as you need to of your financial adviser/lawyer/accountant to be sure you understand.

Also, be careful when you think about pensions in terms of their present value. The present value of a pension isn’t concrete, like money in your bank account. It’s just an estimate based on actuarial projections. So it may be helpful to think of pensions, especially if they are close to pay-out status, as an additional monthly income stream instead of as assets with a fixed value.

Say there is a pension with a present value of $300,000 created solely during the marriage, and you will divide it equally. It might make more sense to equally split the marital monthly pension stream of $3,000 so each of you gets $1,500 per month. One reason is that another kind of split may have more tax impacts. For instance, say one spouse wants to keep the entire $300,000 pension, with all its anticipated future payouts, and buys out the other spouse’s half, $150,000, by letting them keep or receive something worth $150,000. It sounds like an even 50-50 split until the person keeping the pension realizes that the $300,000 value was just an estimate based on projected life expectancy, which may or may not come true. The rules can be complicated, so two good questions to keep at the ready are: What are these projections based on? What are the tax implications of keeping this asset?

3. Get comfortable with the concept and simple math of “equalizing.”

Equalizing is simply the process of determining how much has to be transferred from your partner to you, or vice versa, so each of you will have an equal amount when you divide your marital assets. You’ll hear lots of talk about the “equalization formula,” which can sound complex and daunting.

But it’s actually easy to learn, and you should get comfortable with it. You’ll use it more than you think.

Say you have Amount X in your [savings] account, and your spouse has Amount Y. Use this simple three-step process to equalize your amounts.

a. First, add Amount X (yours) to Amount Y (theirs) to obtain the total Amount Z.

b. Divide Amount Z by 2 to get the equalized amount each person should wind up with, their 50% of the total. Call that Amount E for equal.

c. The person with the larger amount will have to transfer money to the one with the smaller amount. How much? Subtract Amount E from the larger amount.

Below, you can see an example. One party has marital property worth $939,164, and the other’s is valued at 42,820. The total to be equalized, their Amount Z, is 981,984. Half of that, the equalized amount, is 490,992 (seen in the After Equalization box).

When it is subtracted from the larger party’s amount, the difference is $448,172 (seen in the To Equalize box), which is transferred to the party with the smaller worth.

4. Share spreadsheets with the other side early.

In a high-conflict divorce, most of the focus is on the differences. To resolve your divorce, try to focus on what you can agree on.

I had a trial in a high-conflict divorce, where the judge during the trial asked if we could agree on numbers. When both sides looked like deer in headlights, the judge said, “Here is what we are going to do: Plaintiff is going to create a spreadsheet with the date of marriage (DOM), date of commencement (DOC), and date of trial (DOT) valuations of the marital estate and Defendant will review the spreadsheet and see if we can agree on the numbers. That will save us time in this trial so we can stipulate to the figures.”

Since getting that awakening years ago, I have prepared spreadsheets as early as I can in a divorce and shared them with the other side so we can at least start thinking early on about what we can agree on. This tool, I also believe, is a small step that helps parties build trust and settle cases.

Recently, I shared a spreadsheet in settlement discussions, and the opponent actually thanked me in front of the judge for laying out the marital estate so clearly, which the attorney thinks helped us have more productive settlement discussions.

5. Use spreadsheets for settlement projections.

Once you have mapped out the marital estate and a settlement proposal, you can use the spreadsheet to help create settlement projections.

You can list three to five scenarios to map out how things look over time.

For example, say you want $3,000 a month in child support, but the other side will only agree on $1,500, which, let’s say, is the cap.

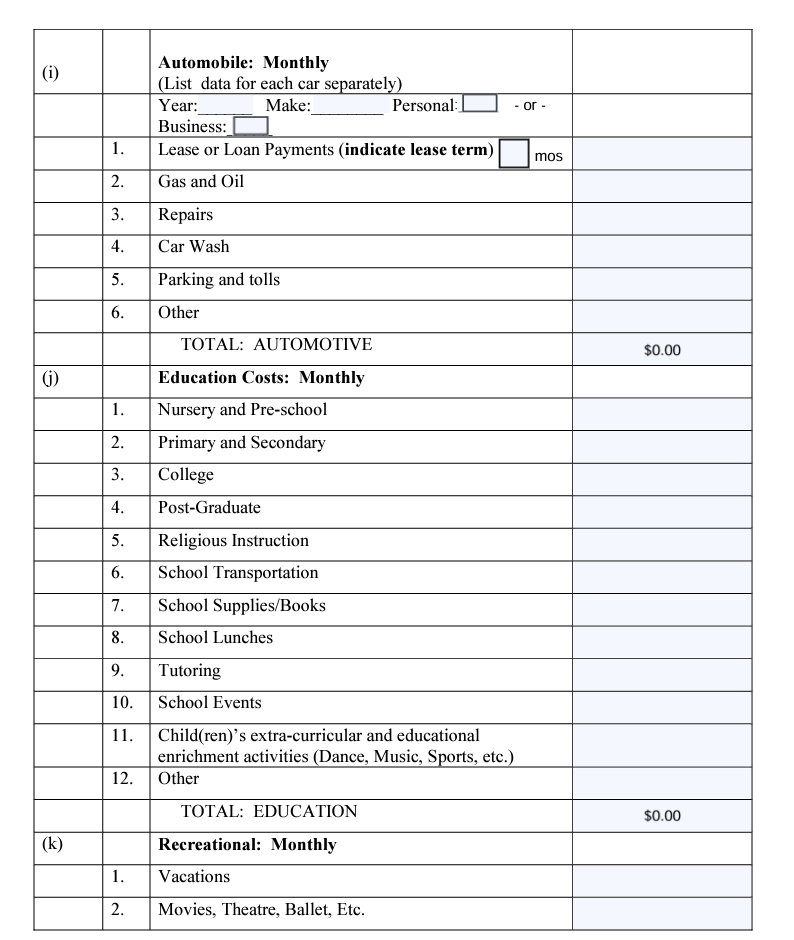

You could put your expenses down in a column and total them. Let’s say your expenses are $10,000 a month.

You can then put your net income in one row and calculate the difference between that and your estimated expenses. If your monthly net income is $8,000 and expenses total $10,00, then you have a need for $2,000 more.

Now, you can work out a few different scenarios. Add five rows to the sheet. In one row, you can have $3,500, and in the rows below that you can have $3,000, $2,500, $2,000, and finally $1,500. See what happens at the end of the year for each scenario.

When you see the raw totals, you can work out what kind of impact they might have on you. For instance, you now could tell your spouse: “If you only let me have $1,500, I’ll be $18,000 short by the end of the year, and that means XYZ. If I had to cut 18,000 from my budget, Junior would not get ABC. On the other hand, if I had the 3,000 I’m requesting, you’ll see we could XYZ. With $3,500 in child support, we could XXX.

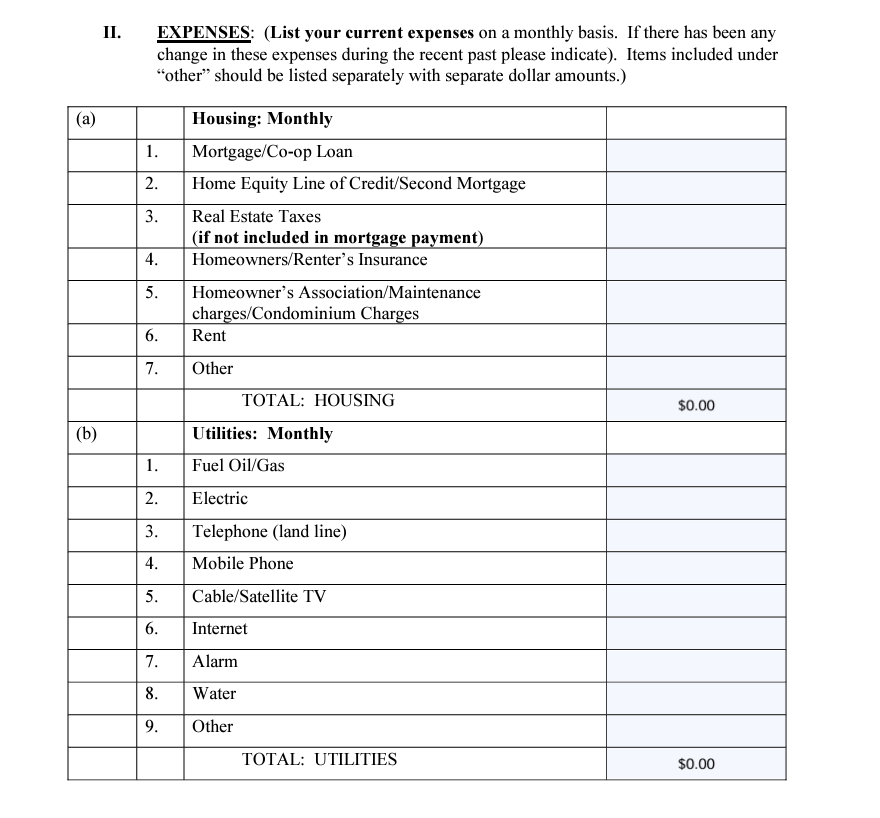

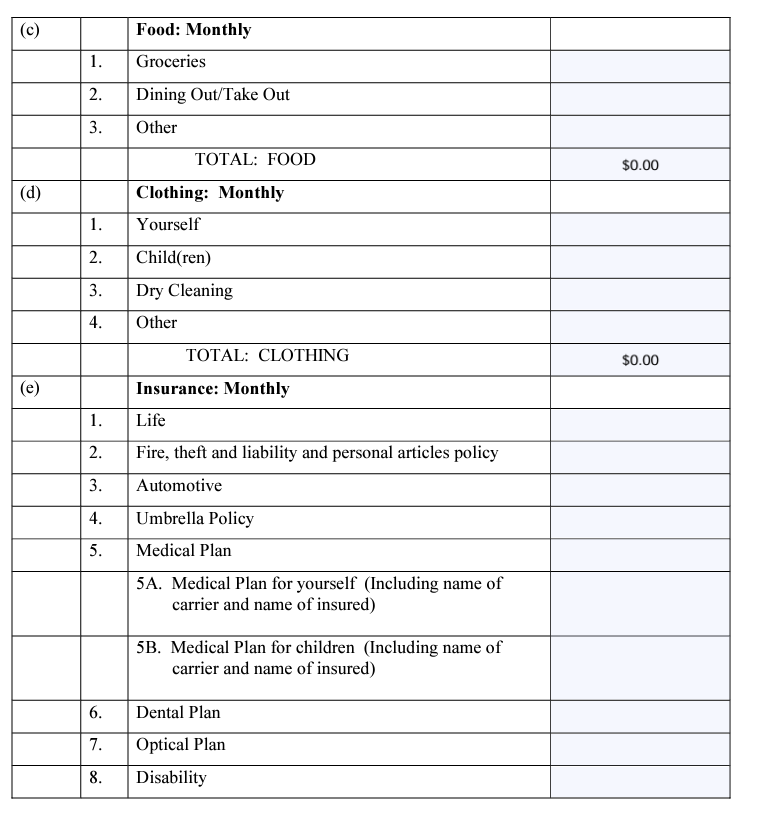

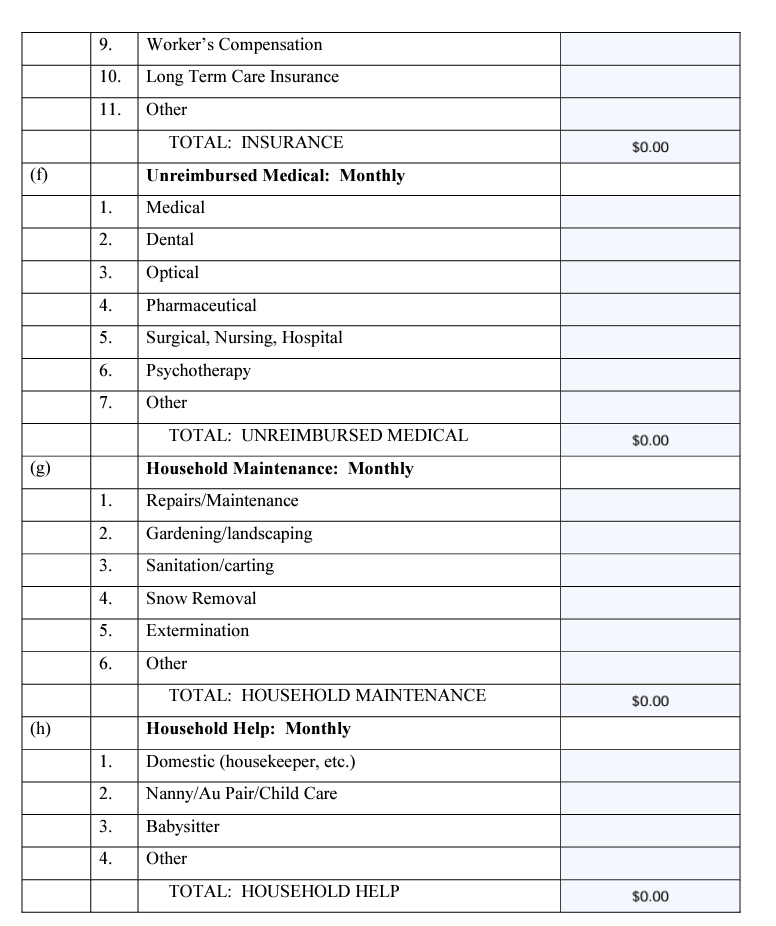

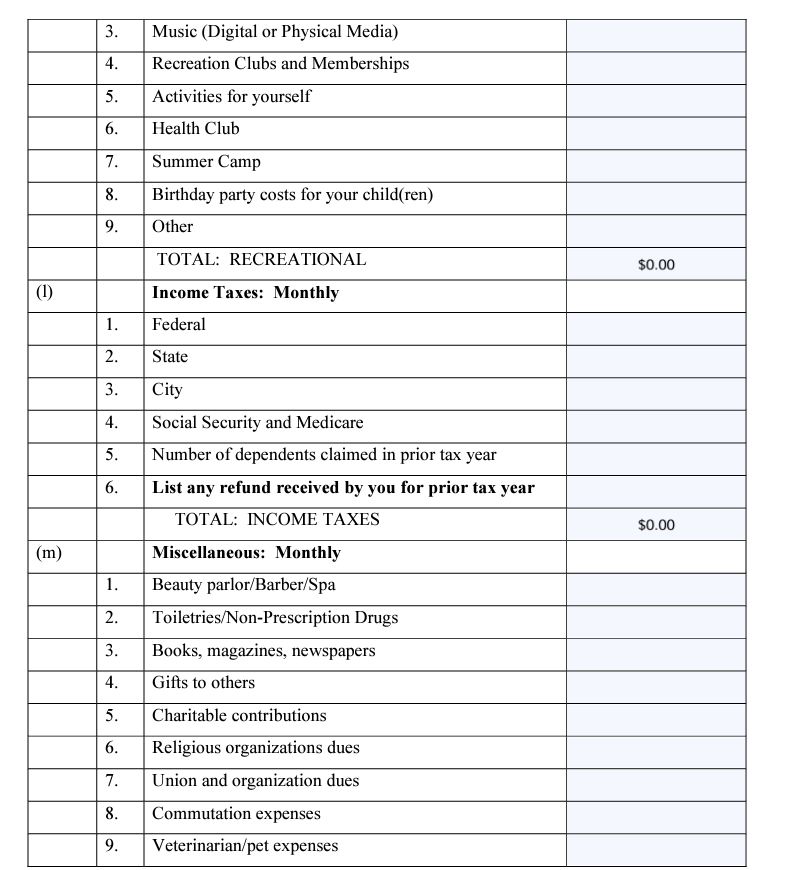

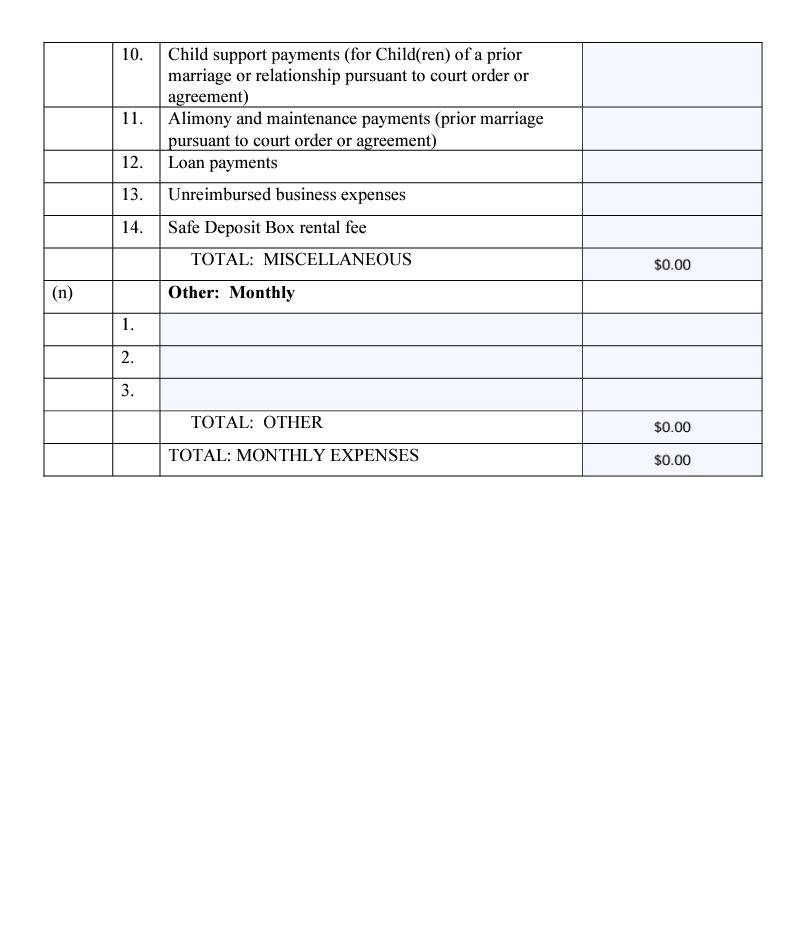

This exercise will also help you determine which expenses can be adjusted. Which expenses are fixed or flexible? What could go if you were forcedenses by $500 or $1000 a month to cut your exp? What would you have to sacrifice? What do you consider to be untouchable necessities? A concrete example of a budget could come directly from the statement of net worth, revised in January of 2024.

Give it a try.

As you can see, spreadsheets can help you efficiently manage and analyze settlements, leading to better decision-making and improved outcomes. Yes, they can see dry and technical. But that’s the point. A plain, boring, no-drama spreadsheet lets you block out the noise. And the more you can do that, the easier it is to focus on what is important to you: getting closer to your post-divorce life.